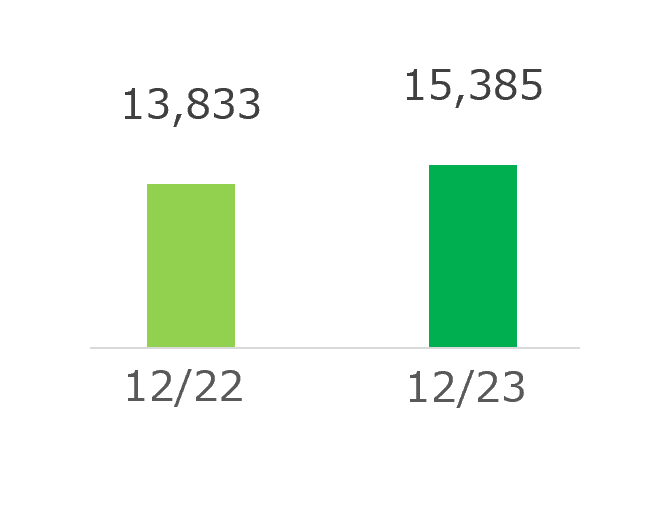

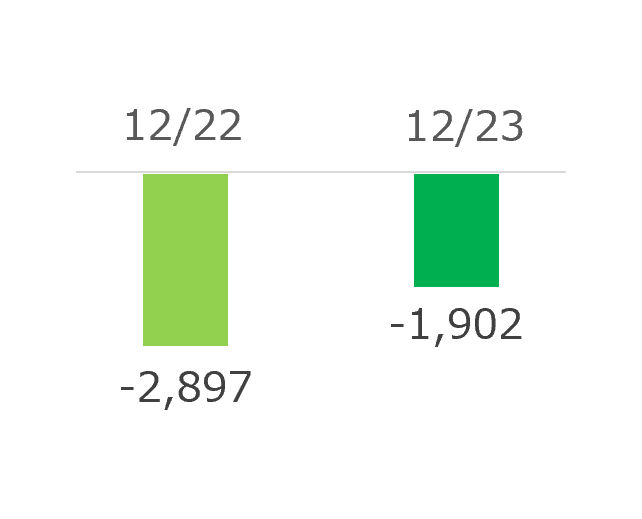

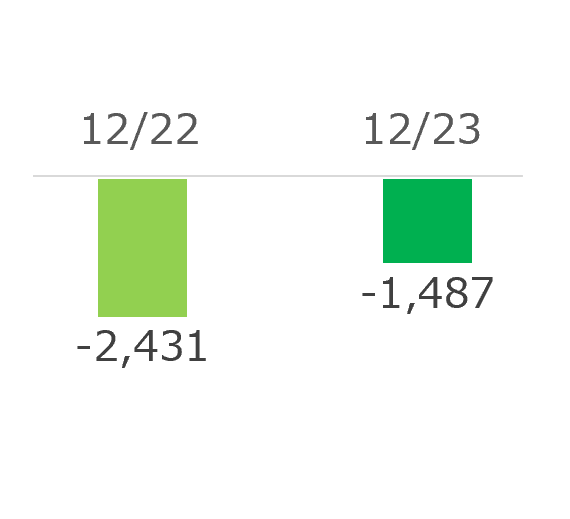

Business Performance(Consolidated/IFRS)

Analysis of Performance

[Million Yen]

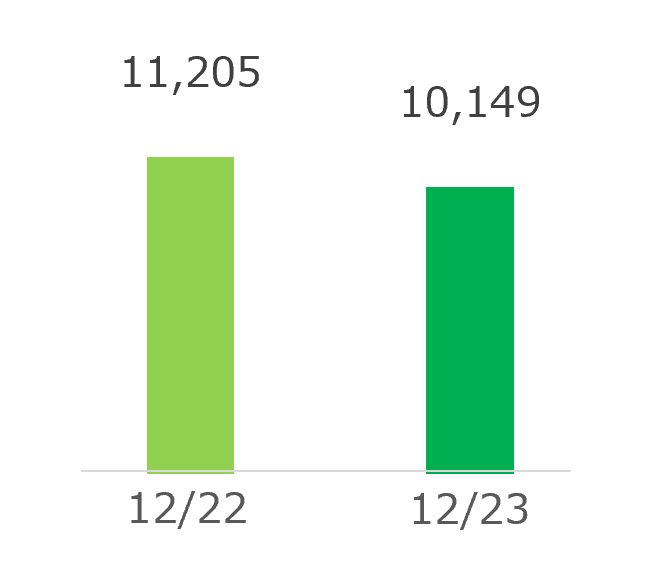

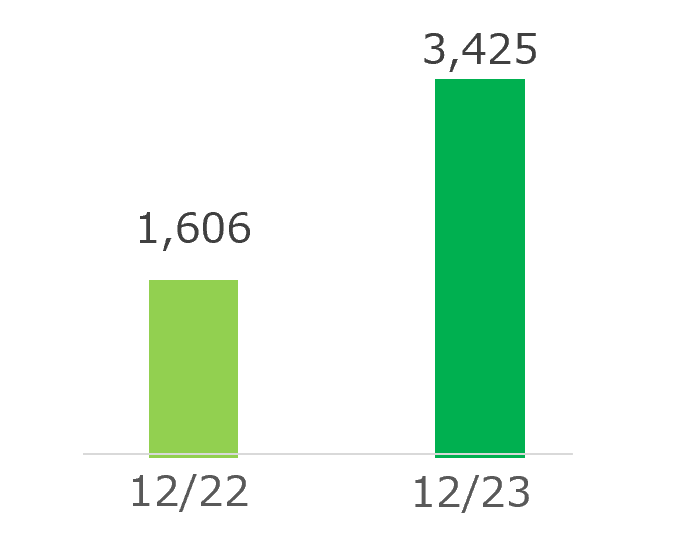

| Revenue

|

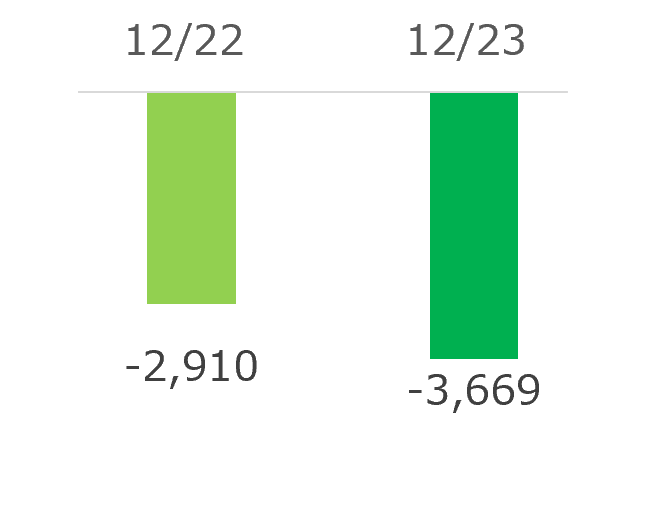

Operating profit

|

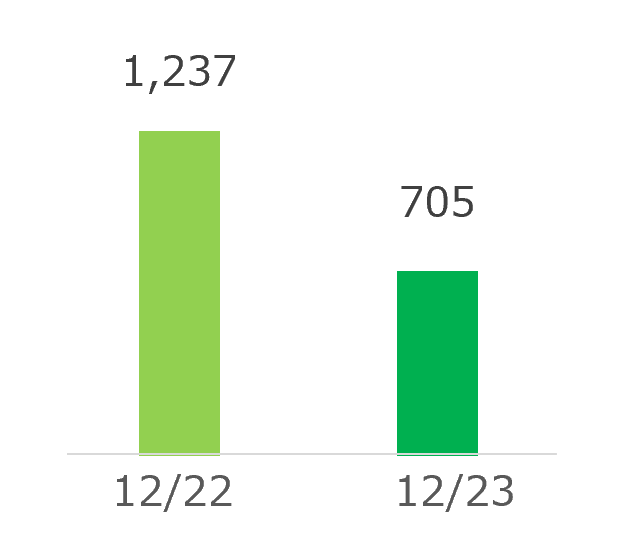

Profit attributable to

owners of the parent |

|

|

|

|

| Revenue increased due to a rise in monthly subscription-type cloud software users.

|

Operating loss decreased due to an increase in revenue as well as cost reductions such as improved operational efficiencies.

|

Since loss was booked as deferred tax asset and tax effect accounting was applied, the amount of loss attributable to owners of the parent was as described above.

|

※Minus represents a loss

Data for the past 5 years:

Results of Operations

Definition of terms:

Glossary

Results forecast

Since the number of users for monthly subscription-type cloud software is expected to increase further and initial development costs is expected to peak out, we anticipate that revenue will exceed the break-even point, leading to a forecast of a return to profitability (as of August 8, 2024).

Revenue by Service Categories(Consolidated/IFRS)

Broadleaf Group has a single business segment (IT services).

Revenue by service categories is disclosed in order to explain the detail of the revenue.

[Million Yen]

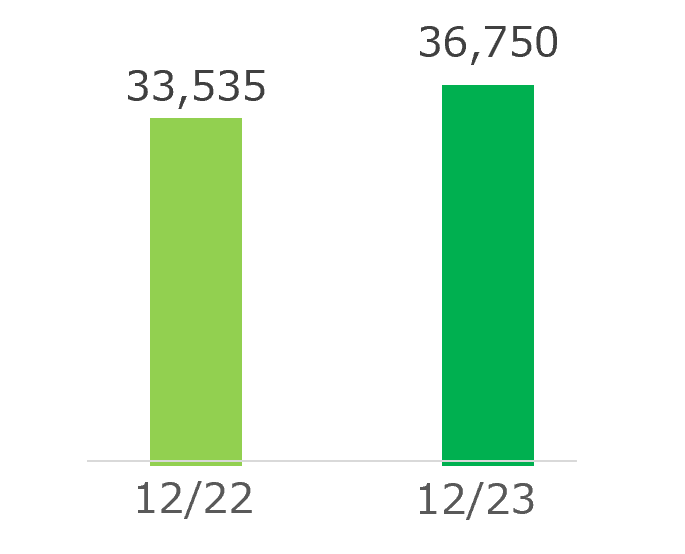

| Could service |

Packaged system

|

|

|

|

| Sales of cloud software and other monthly subscription-type services resulted in an increase in sales.

|

Sales declined due to a decrease in packaged software users as a result of the transition to cloud software.

|

Revenue forecasts by service categories:

Segment Information

Definition of terms:

Glossary

Analysis of Financial Condition(Consolidated/IFRS)

[Million Yen]

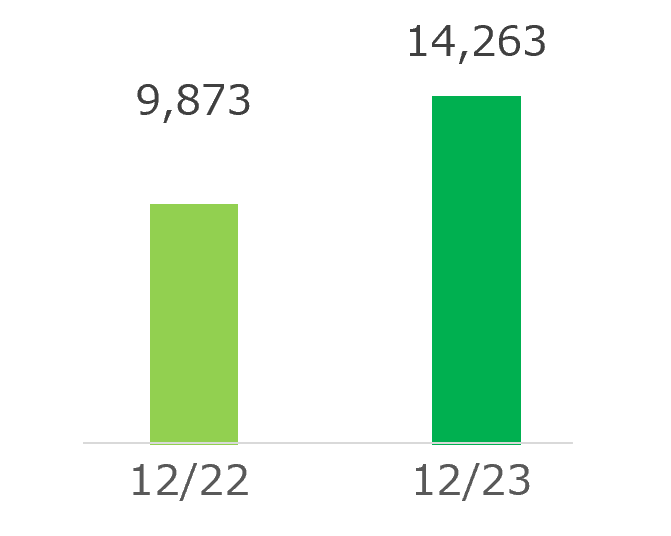

| Assets

|

Liability

|

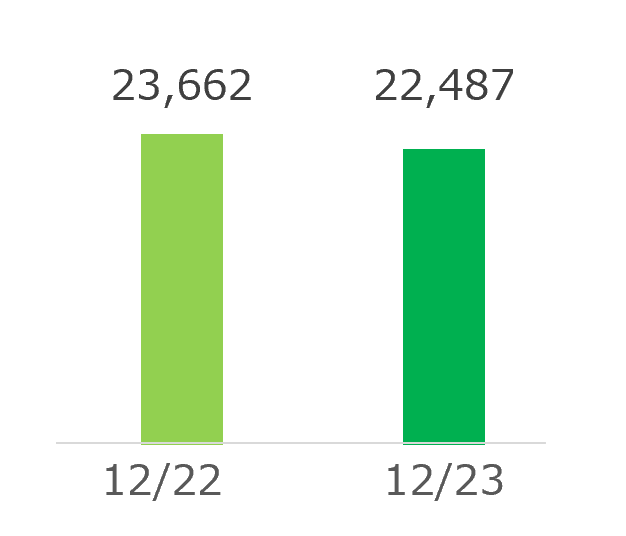

Equity

|

|

|

|

|

| Intangible assets increased due to cloud service development, resulting in an increase in non-current assets.

|

The increase in multi-year contracts for cloud software led to a rise in contract liabilities, resulting in an increase in current liabilities.

|

Total equity decreased due to dividend payouts and book of loss for FY2023.

|

Data for the past 5 years:

Financial Position

Definition of terms:

Glossary

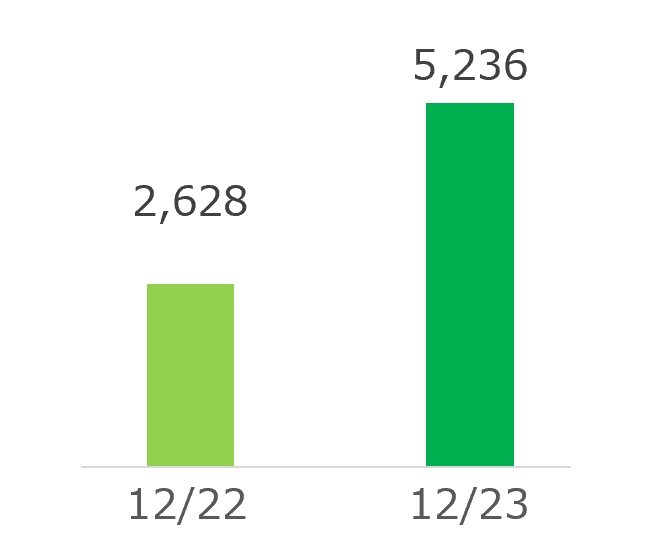

Analysis of Cash Flow(Consolidated/IFRS)

[Million Yen]

| Operating Cash Flow

|

Investing Cash Flow

|

Financing Cash Flow

|

|

|

|

|

| Income increased due to a rise in multi-year contracts for cloud software.

|

Expenditure increased due to enhanced development of cloud services.

|

Income decreased due to reduction in proceeds from long-term borrowings.

|

Data for the past 5 years:

Cash Flow Status